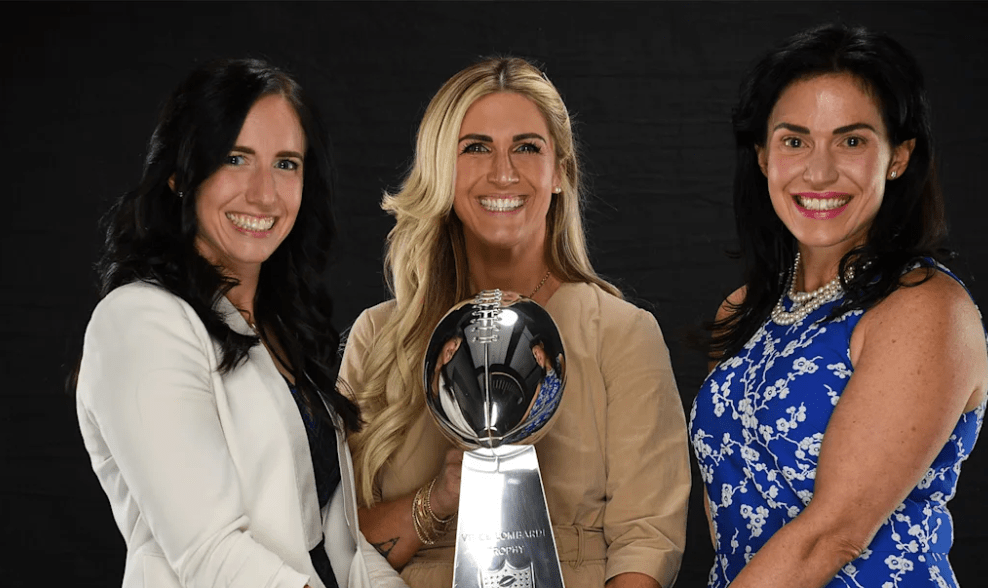

Big Ten Explores $2 Billion Private Capital Deal

Big Ten Explores $2 Billion Private Capital Deal

The Big Ten Conference is reportedly in discussions to form a $2 billion private capital partnership.

This move, tentatively named “Big Ten Enterprises,” would create a commercial entity to manage revenue-generating activities such as media rights, sponsorships, and league revenue.

The proposed deal involves private investors who would provide upfront cash to member schools in exchange for equity shares.

However, these investors would not have voting control, preserving the universities’ autonomy.

The funds would be distributed based on factors like school budgets and brand power, potentially favoring larger programs like Ohio State and Michigan.

Kendall & Casey argue that this development underscores the commercialization of college sports, prioritizing profit over tradition and education.

They likened the shift to the themes of the movie Blue Chips, where the love of the game is overshadowed by financial pressures.

Kendall & Casey expressed concern that college athletics has become a “mini professional league,” eroding the connection fans once had with student-athletes who stayed with programs for years.

The Big Ten’s move reflects broader trends in college sports, where rising costs and the influence of NIL (Name, Image, Likeness) deals have transformed the landscape.

While the deal could make the Big Ten one of the most powerful entities in sports, it also raises questions about the future of collegiate athletics and its impact on the student-athlete experience.