Taxpayers First: Library Spending Scaled Down

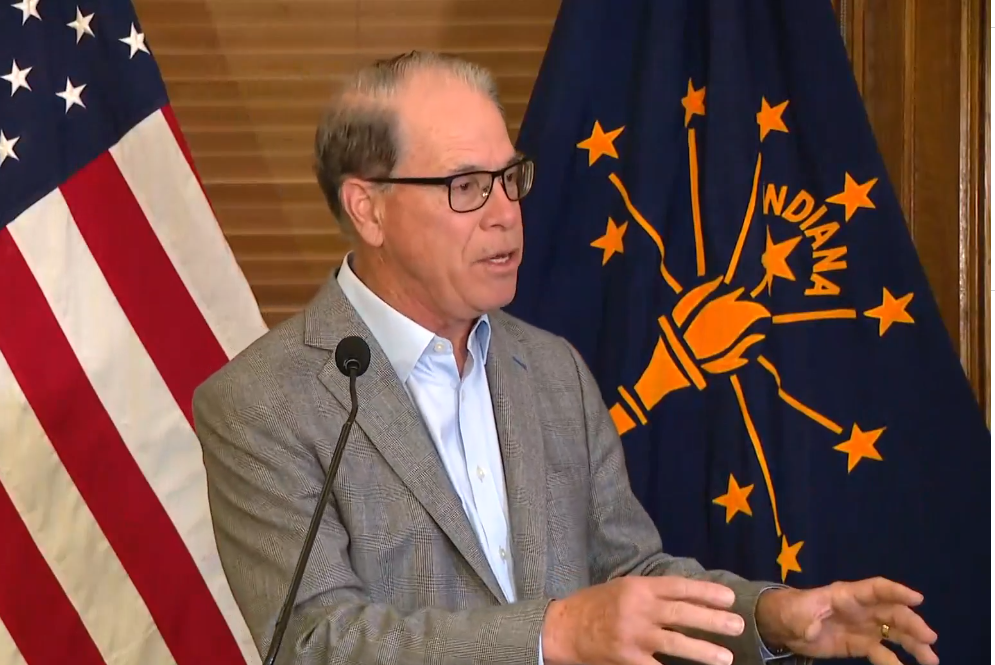

Kendall: “They don’t care about you being able to pay your bills or stay in your home. They’re mad you’re getting $300 back and they’re basically trying to make you think they’re going to shut the doors.”

Indiana’s new tax law, Senate Enrolled Act 1, delivers average property-tax savings of about $300 per homeowner but causes concern for public libraries that depend on property and local income taxes for funding. The reform limits future property-tax growth and reshapes how local income tax dollars are distributed, leaving libraries uncertain about long-term stability. Library leaders warn that by 2028, many systems could face steep financial shortfalls.

Some libraries are already tightening budgets by freezing hiring, merging departments, and cutting contracts. These measures are temporary, as SEA 1 sets lasting constraints on revenue growth. At the same time, federal funding through the Institute of Museum and Library Services has ended, and the Indiana State Library’s budget has been reduced.

Kendall and Casey weigh in on the matter: